What is Jock Tax and why is Michael Jordan responsible for it?

Exploring the origins, impact, and adaptation of the Jock Tax policy for professional athletes in the United States.

Michel Jordan ( Image via Core Compass )

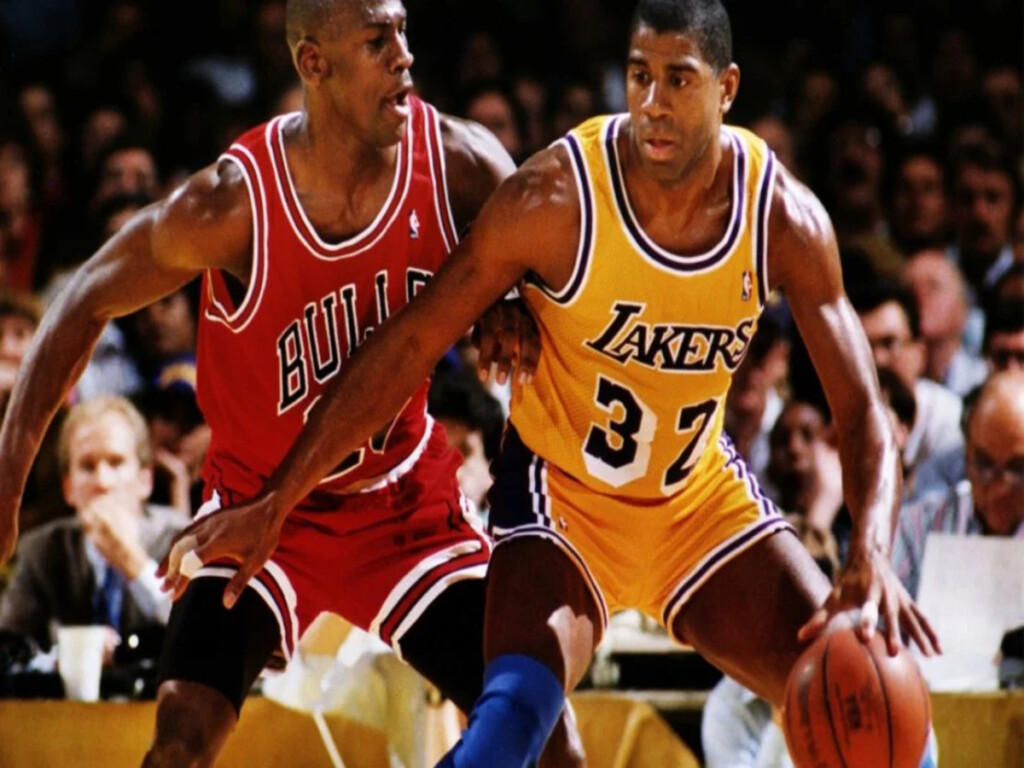

Professional athletes in the United States are subject to a dizzying array of tax laws, many of which are exceptionally convoluted. One such tax is the Jock Tax, which has its roots in the 1990s when Michael Jordan and his Chicago Bulls team won the 1991 NBA Finals over the Los Angeles Lakers. The state of California, where the finals took place, demanded that Jordan and his team pay taxes on their earnings from playing in the state, giving rise to the Jock Tax.

Athletes are required to pay income tax in each state where they compete under the Jock Tax regulation. This implies that a single athlete may wind up submitting 10 to 25 tax returns each year. Athletes who make over $1 million a year may pay more than $100,000 in taxes to areas where they do not even reside.

As you might guess, this has given athletes and their accountants a lot of trouble as they try to understand the complex and varied tax laws, rates, and deductions that apply in each state.

Athletes have managed to adjust and even take advantage of the tax despite its intricacy. For instance, to save money, some players choose to reside and play in places like Florida, Texas, and Nevada, which have lower tax rates.

In contrast, athletes who play for teams in states with high taxes may have to pay a sizeable portion of their income in taxes. Intriguing free agency decisions have resulted as athletes assess the benefits and drawbacks of joining organizations based on their tax laws.

Michael Jordan was responsible for the implementation of jock tax in the United States

The Jock Tax policy was first enforced in the 1960s but gained significant attention in the 1990s during Michael Jordan’s time with the Chicago Bulls. After winning the 1991 NBA Finals, the Bulls returned to Chicago to hold their championship parade. However, California demanded that Jordan and his team pay taxes on their earnings from playing in the state during the finals.

Illinois, where the Chicago Bulls (Jordan’s team) is based, retaliated by passing a new bill known as “Michael Jordan’s Revenge.” This bill imposed income taxes on athletes from California and any other state that taxed Illinois residents. The move was so successful that other states soon followed suit, leading to the widespread adoption of the Jock Tax policy.

Today, almost every state hosting professional sports teams has its own Jock Tax policy, and a few cities have adopted it. Athletes who play for teams in high-tax states may end up paying a substantial amount of their tax earnings, leading to some intriguing free agency decisions.

According to Huddle Up, some athletes sign with teams in low-tax states to save money, while others take home less money to play for teams in high-tax states. Overall, the Jock Tax is a complex and multi-layered tax policy that athletes in the United States must navigate each year.

The Jock Tax is a complicated tax policy that athletes in the United States must navigate each year. The policy requires athletes to pay income tax in each state where they play games, which can result in filing between 10 to 25 tax returns yearly.

Despite its complexities, athletes have learned to adapt and use the policy to their advantage by signing with teams in states with lower tax rates. The Jock Tax has become a widespread policy nationwide, thanks in part to Michael Jordan and the Chicago Bulls.

In case you missed it: